The BRICS Currency and its Ripple Effect on Gold: A New Era for Precious Metals

The BRICS nations – Brazil, Russia, India, China, and South Africa – have long been significant players on the global economic stage. In recent years, there has been speculation about the potential creation of a new common currency for these emerging market powerhouses. This prospect raises intriguing questions about the impact such a currency could have on various financial instruments, particularly gold. In this article, we explore the potential implications of a BRICS currency on the precious metal market and how it might reshape the dynamics of global finance.

The Rise of BRICS and the Currency Conundrum

The BRICS nations have been gradually asserting themselves as economic powerhouses, challenging the traditional dominance of Western economies. The idea of a common currency for these nations has been floated as a means to enhance financial cooperation, reduce dependence on the U.S. dollar, and create a more balanced global economic order. If this vision materializes, it could mark a seismic shift in the dynamics of international finance.

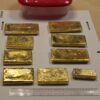

Gold as a Safe Haven

Gold has long been regarded as a safe haven asset, a store of value immune to the fluctuations of fiat currencies. Investors often turn to gold in times of economic uncertainty or geopolitical instability. The potential introduction of a BRICS currency could alter the dynamics of this traditional safe haven.

Impact on the U.S. Dollar

One of the significant potential consequences of a BRICS currency is a reduced reliance on the U.S. dollar in international trade. Currently, many global transactions are denominated in dollars, and gold prices are often influenced by the strength or weakness of the greenback. If a BRICS currency gains prominence, it could diminish the influence of the U.S. dollar, subsequently impacting the valuation and demand for gold.

Diversification of Reserves

Central banks and sovereign wealth funds worldwide hold significant reserves in gold as a means of diversification. The advent of a BRICS currency may prompt these institutions to reassess their reserve strategies. If the new currency gains credibility and stability, central banks could diversify their reserves by holding assets denominated in this currency, potentially impacting the demand for gold as a traditional reserve asset.

Market Volatility and Opportunities

The introduction of a BRICS currency could introduce a new element of volatility to the global financial markets. Investors may reevaluate their portfolios, seeking to capitalize on emerging opportunities and hedge against potential risks. This heightened volatility could have both positive and negative effects on the price of gold, depending on market sentiment and economic conditions.

The potential introduction of a BRICS currency presents a fascinating scenario for the world of finance and, by extension, the precious metals market. As these emerging economies seek to reshape the global financial landscape, the implications for gold are multifaceted. Investors and market observers should closely monitor developments, recognizing that the interplay between a new currency and gold prices could usher in a new era for precious metals as traditional financial dynamics undergo a transformative shift.

Add comment